From Smoot-Hawley to Trump: The Return of Trade War Fears

From Smoot-Hawley to Trump: The Return of Trade War Fears

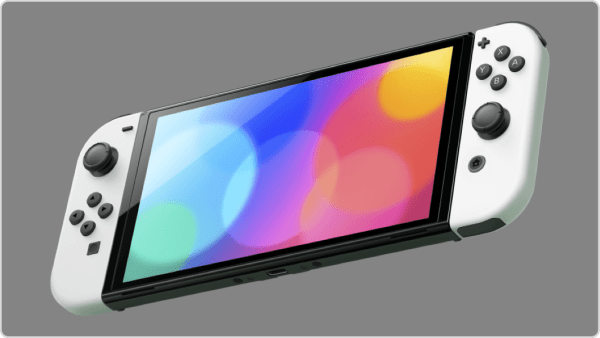

The recent wave of tariff impositions by U.S. President Donald Trump has sparked concerns of a potential new global trade war. Since returning to the White House on January 20, Trump has introduced tariffs on various countries and products. His most striking move came on April 2, a date he dubbed "Liberation Day," when he imposed a blanket 10% tariff on all imported goods entering the United States.

In addition to the blanket tariff, Trump introduced significantly higher tariffs for certain nations, including a 34% duty on Chinese imports and 20% on goods from the European Union. He claimed these measures were necessary to combat the United States' growing trade deficit. However, the aggressive trade stance has drawn widespread criticism, with retaliatory tariffs quickly announced by other countries, especially China.

Many analysts draw historical parallels between Trump’s actions and the infamous Smoot-Hawley Tariff Act of 1930. That piece of legislation is widely blamed for worsening the Great Depression. During the two years following its enactment, U.S. imports and exports dropped by approximately 40%. Nations like Canada and several European countries responded by raising their own tariffs on American products.

The resulting chain reaction devastated global trade. According to several reports, worldwide commerce plummeted by around 65%, and numerous banks failed. This economic domino effect pushed the global economy into a deeper crisis. Economists fear that a similar escalation today could have comparable consequences if not properly managed.

Although it remains unclear how this latest chapter of the trade conflict will conclude, recent studies suggest that tariffs tend to slow economic growth and fuel inflation in the countries involved. Instead of encouraging domestic prosperity, protectionist policies often backfire by hurting the very consumers and businesses they aim to protect.

During Trump’s first term, several academic reports indicated that his tariffs not only hurt foreign companies but also damaged U.S. businesses and raised costs for American consumers. The increased expenses were felt across various industries, leading to higher prices for everyday goods. Rather than improving household incomes, tariffs effectively acted as an additional tax on consumers.

Moreover, despite their controversial implementation, the revenue generated from tariffs remains minimal compared to the government's income from individual and corporate taxes. While the political appeal of tariffs may be strong, their actual contribution to the national budget is relatively insignificant, raising questions about their long-term effectiveness as a fiscal tool.

What's Your Reaction?

:format(webp)/cdn.vox-cdn.com/uploads/chorus_image/image/70136881/1347078605.0.jpg)