iPhone Prices Set to Soar: How Trump’s Tariffs Could Shock Your Wallet

iPhone Prices Set to Soar: How Trump’s Tariffs Could Shock Your Wallet

If you thought $1,000 for a new iPhone was steep, brace yourself—prices for Apple devices and other popular tech may be headed even higher. President Trump’s newly enacted tariffs on Chinese goods could drive up costs for everything from smartphones and laptops to smaller accessories like earbuds and computer mice. With Apple’s manufacturing chain deeply rooted in China, analysts warn that iPhone prices may rise significantly in the coming weeks or months.

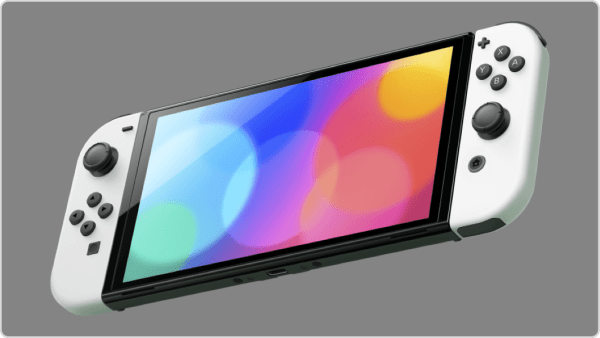

Apple now faces a challenging situation: the White House has imposed a 145% tariff on Chinese imports, signaling a sharp escalation in the ongoing trade war. Trump also announced a 90-day pause on tariffs for all other countries, isolating China as the primary target. While Apple had previously received exemptions under earlier administrations, it remains uncertain whether such relief will be granted again. In the short term, Apple will likely manage its current iPhone inventory in the U.S. carefully, but lasting tariffs could force larger changes to its operations.

According to market analysts, nearly 90% of iPhones are assembled in China. If the tariffs persist, the added cost of production will likely be passed on to consumers. The scale and speed of these price increases depend largely on how much inventory Apple already has in U.S. stores—and how quickly that supply runs out. With the next iPhone not due until September, price hikes could still hit earlier if demand remains strong and inventory dries up.

Industry experts estimate that Apple’s U.S. inventory could last anywhere from three to six weeks, depending on demand. Ryan Reith from IDC suggests that inventory may be stretched for about three weeks, while Canalys and Counterpoint Research offer slightly longer projections. Recent shipment data even shows an uptick in device imports, likely in anticipation of rising costs. Once stockpiles are depleted, price increases could hit across Apple’s lineup—and possibly other smartphone brands as well.

Just how much could prices increase? UBS analysts suggest a dramatic $800 hike for the top-tier iPhone 16 Pro Max if assembled in China, due to the 125% tariff. In contrast, the same model assembled in India would only cost about $45 more. This stark difference has sparked discussion about diversifying production. Some U.S. carriers may try to soften the blow by offering discounts on older models or by promoting installment plans, which currently account for 55% of phone purchases in the U.S., according to Consumer Intelligence Research Partners.

Despite growing pressure, moving iPhone production to the U.S. isn’t a simple solution. While Apple has shifted some assembly to India and Vietnam in recent years, analysts note that critical components still largely come from China. Experts like Ryan Reith and Harvard Business School’s Willy Shih point out that building iPhones in the U.S. would not only be expensive—potentially costing up to $3,500 per unit—but also require a scale of labor that’s hard to find locally.

Apple has committed $500 billion to expand its U.S. presence, but that investment won’t include iPhone factories. Instead, the money is earmarked for initiatives like building server farms and educational programs for small businesses. Even if Apple did commit to U.S. iPhone manufacturing, new facilities would take years to become operational—while it’s still unknown how long the tariffs will last.

As Apple navigates this turbulent period, analysts speculate that it may consider shifting its product launch calendar to adapt to tariff-related disruptions. Although Apple has made no official announcements, experts like Reith suggest a temporary change to its release strategy—similar to how it launched iPhones a month later during the pandemic in 2020—could be one of several tactics used to ease the impact on consumers and the company’s bottom line.

What's Your Reaction?

:format(webp)/cdn.vox-cdn.com/uploads/chorus_image/image/70136881/1347078605.0.jpg)